Though experiencing a decline in trading rates, the trading volume of polymers is still high, according to Wikiplast.

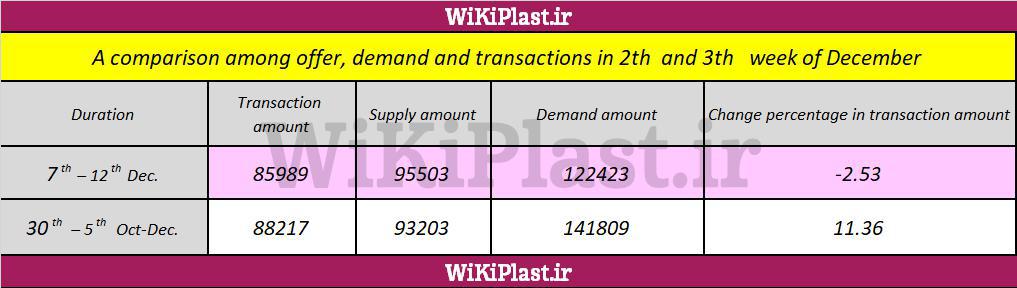

In the last week, the volume of demand dropped by 20,000 tons, indicating a decline in market attractiveness or a limitation in placing orders on the commodity exchange.

The downturn is partly due to the restrictions on Behinyab codes which have not recorded their manufacturing and sales on the Behinyab website.

The output along with supply growth promotes no major change on the market. Nevertheless, the USD inflation rate has affected the petrochemicals market less than other markets.

The stocks are also very high, signifying excess supply in the domestic market. However, considering the USD price decline, buying tendency may still reduce, though not drastically.

It is rare to see increasing base prices on the commodity exchange accompanied by a price reduction in the domestic market; however, the price gap between the commodity exchange and the market should also be considered.

In the last week, the trading volume of polymers on the commodity exchange was around 86,000 tons, which is a prominent figure. However, we also witnessed a drop in demand by %13.67.

These facts are likely to be accompanied by a production boost in the complementary industries, although this claim is not consistent with price fluctuations in the domestic market.

More precisely, prices in the free market should have been higher, and with the increase in the USD rate, there were expectations of price rise in the domestic market which were not met.

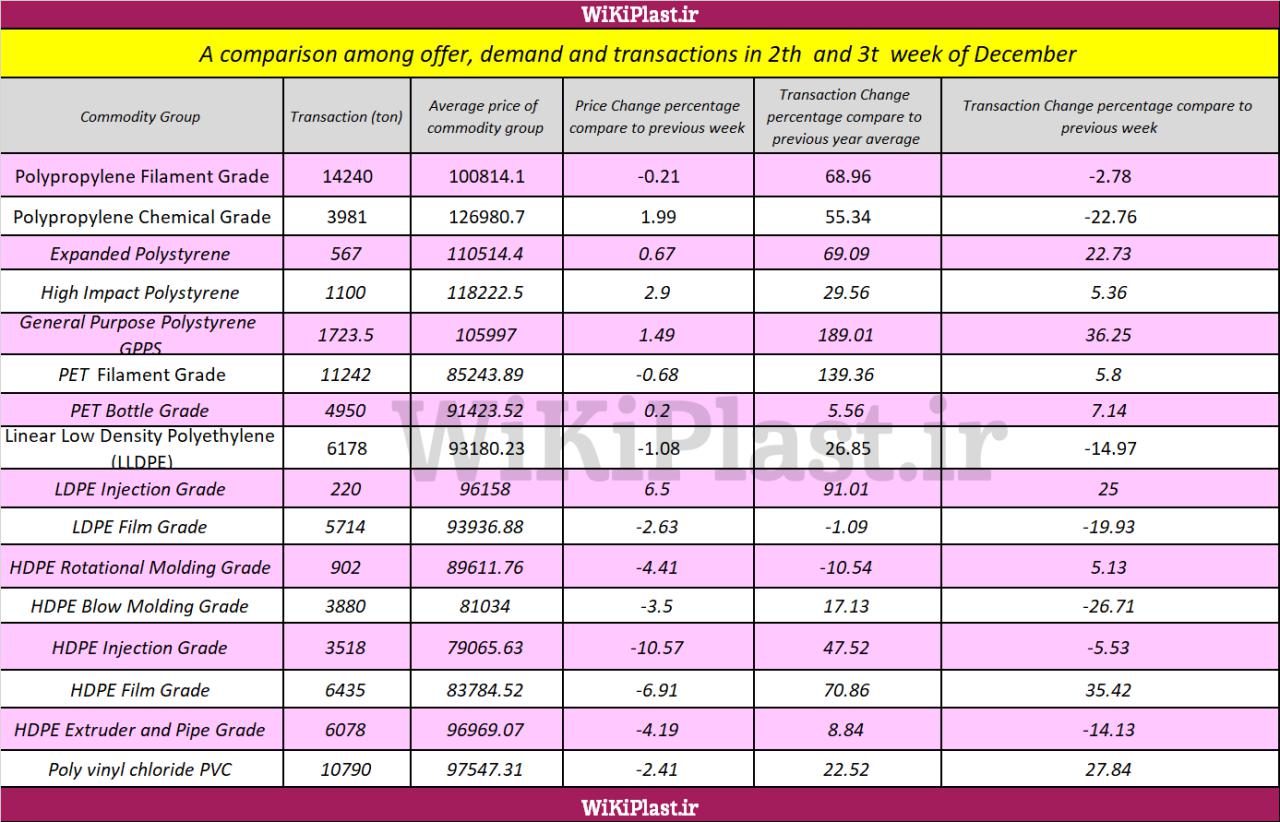

The fact is that, over the last few weeks, the trading volume on the commodity exchange is much higher than the real demand in the complementary industry, meaning that the expected market improvement was not achieved. The same fact has been decelerating price growth.

On the other hand, the trading volume of the commodity chemicals has dramatically increased, indicating an improvement in the real production of this industry and thus an upcoming market improvement. However, it may not result in a price rise.

Although base prices are likely to increase in the commodity exchange and accordingly in the market, all is mere speculation until the basic prices are officially announced.

A look at price fluctuations compared to the previous week also show a decline in the price of a few commodity polymer groups, which could be attributed to a decrease in demand and competition.

Write your comment

Related contents

- The effect of the half-closed week on the polymer market

- Serious resistance of the polymer market

- What can prevent Polymer trade rates from dropping?

- Continuous improvement and the consequences of changes in the market

Wikiplast

Wikiplast