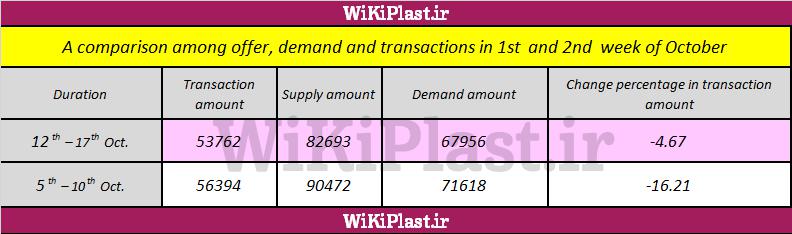

According to Wikiplast, the offers of Polymers in stocks market have fallen by 8.6%, which caused the demands to fall by 5.1% to reach 68,000 tons.

This is the lowest rate in the past 5 weeks, but we can blame some of it on the decrease in offers, interpreting a positive atmosphere in the market.

Last week, the Polymer trade rates dropped by 4.7% to reach 53,763 tons, which is similar to the average amount in the first half of this year.

About 65% of the offers were actually traded last week, which exceeded the amount of demands for the third consecutive week.

This shows that the market is approaching a critical point.

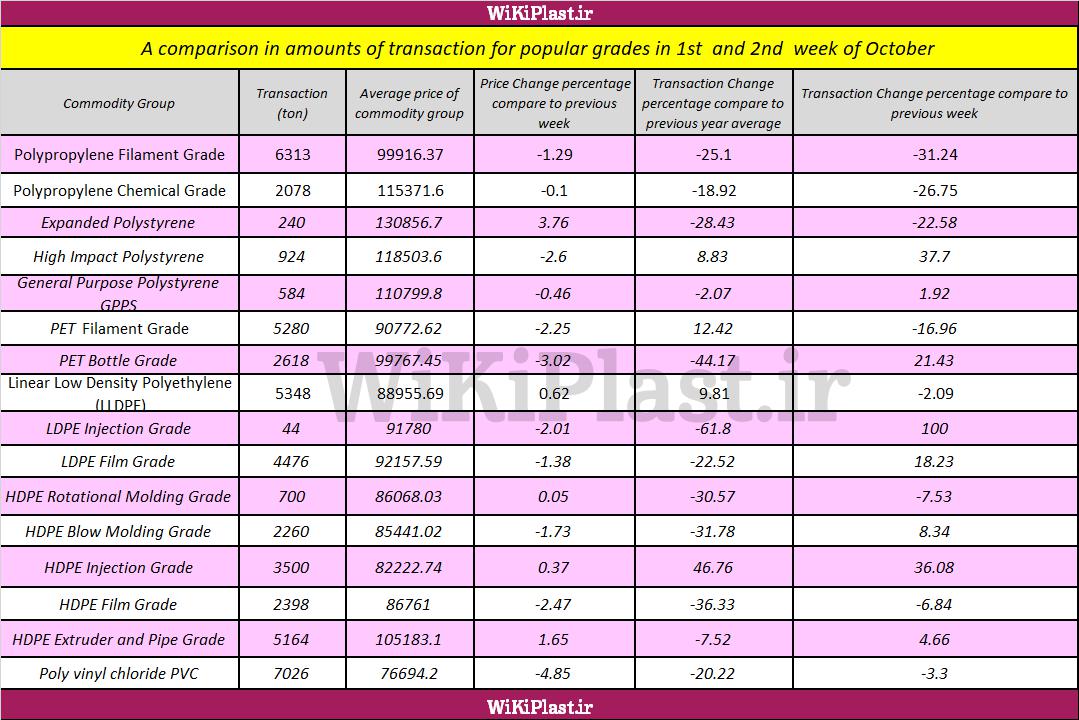

There are multiple critical points playing a role here: The trade rate is about 2,000 tons above the overage of the first half of the year. The proximity of these two rates maybe a sign of positive change.

The gap between governmental exchange rate and the free exchange rate has reached 7,000 IRR, which is the highest since July and can be encouraging for exports.

The market in Iraq will soon be ready to begin trading with Iran and this means the demand for raw materials will rise.

On the other hand, the free market shows some sparks of growth in prices. This indicates that there are demands in the heart of the market.

All these, along with the drop in trade rates, will result in low inventory which will probably lead to rising demands.

The governmental exchange rate is slightly decreasing, but the drop is insignificant and global fluctuations have more impact on the stocks prices.

The growth in supporting manufacturing work is promising a rise in the amount of trade rates.

Of course all this is mere predictions, yet the potentials are strong.

However, the stocks prices dictate the eventual prices and the growth in stocks prices might have a positive impact on the amount of demands as well.

On the opposite side, if we witness further decrease in base prices, it might result in even lower demands.

Never the less, the actual demand by the final users will persist and if the actual demand experiences a rise, the market will once again show signs of growth.

Write your comment

Please send your phone number to connect in whatsapp Send reply

I hope this message finds you in a good health, I would like to know what's the current price of HDPE 3840 UA in USD CFR Nemroz border Afghanistan.

If you could please provide me the following request as soon as possible.

Kind Regards

Send reply

Related contents

- Disregard of Polymer Market for USD Rate

- Serious resistance of the polymer market

- Continuous improvement and the consequences of changes in the market

- Growing trade rate in a week with many holidays/ Last steps before passing recession

- Persistent pessimism in the market

- New hopes for further rise in demands

Wikiplast

Wikiplast