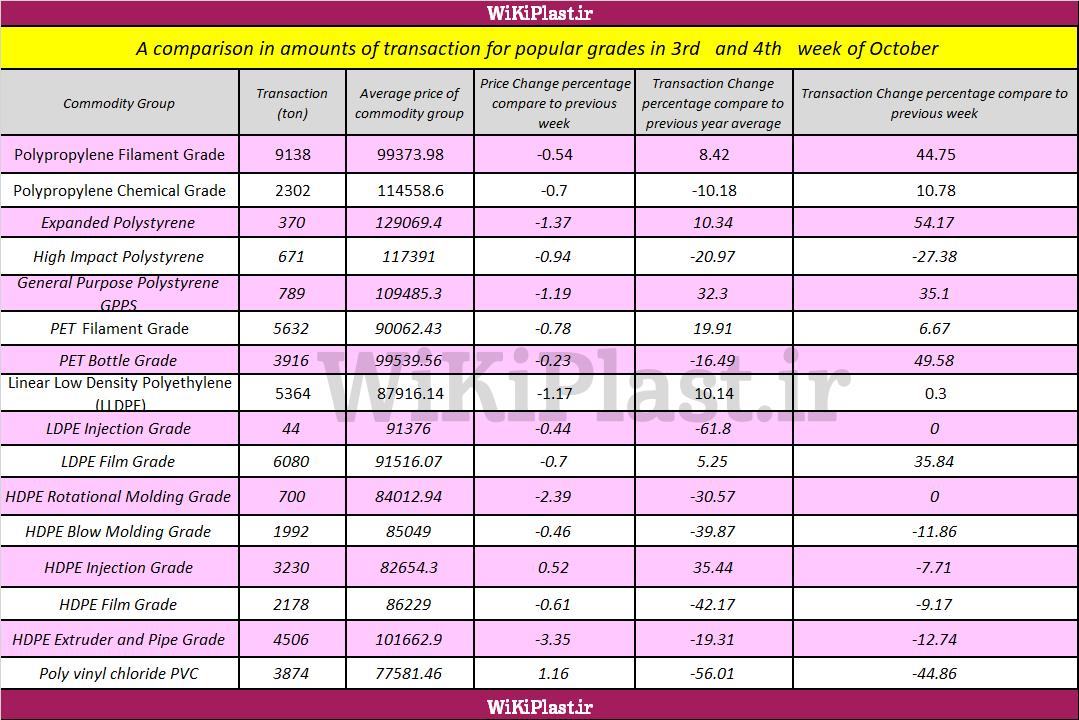

According to Wikiplast, this week's market position did not change significantly compared to the previous week; it was in a condition that the basic prices had a limited decline.

The market accepted the same price decline, but we saw that the resistance has exposed to the decline of the more severe drop in the weeks before it appeared that the demand for the market exceeded the commodity stock.

spite of the decline of prices as well as decreasing demand, we witnessed the market of commodity stock polymers with a slight increase in the volume of transactions, which indicates that the market reacted to signals that we pointed out last week.

Of course, we can't talk like the previous literature for the coming week, as a half-week is coming, and a drop in demand prices will not be surprising, but we see a rise in basic prices that may be perceived to be possible, but we can see the phase shift in the market more clearly.

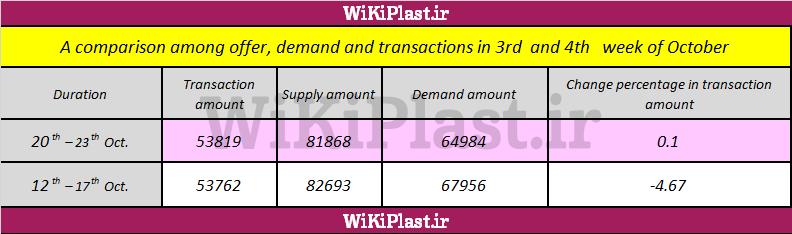

Transactions behavior in the last two weeks showed that the trading volume of nearly 54,000 tons is a psychic resistance in the market, and even with the base price fluctuating, trading above 52,000 tons is still optimistic.

The 52,000 is unconsciously important to the market, with an average trading volume of the first six months of this year, and may be effective for the next few days, though only based on experience and expectations can the traded volume of polymers in the commodity exchange can remain at this level and even increase. Although this speculation is not very valuable for a half-week break.

In global markets, however, we see some sparks of price rise, but due to the lack of basic prices this week on the scale of global prices, we cannot comment on the prospect of basic prices, but we could not expect a big change in basic prices for the week ahead.

The market has spent two hard weeks, and the third week is half-closed. This transaction condition can continue for the third week, but the market appears to be passing through the volume of transactions.

This claim is very important because it means waiting for the market to improve in the coming weeks and is a great sign of the end of the recession in the polymer industry and market.

The evidence on the market suggests that the volume of production will improve over time and that the process can continue, but its output is still not visible to the market.

In the upcoming week, if we witnessed the volume of dealings on the commodities exchanges, it would mean the start of a new period in the polymers market, which will have attractive outputs.

These limited sparks of the rise in the price of polymers considered as an important matter because it can be new guide lights for the future of the market, although it is not yet ripe for comment.

Write your comment

Related contents

- Disregard of Polymer Market for USD Rate

- What can prevent Polymer trade rates from dropping?

- Continuous improvement and the consequences of changes in the market

- Growing trade rate in a week with many holidays/ Last steps before passing recession

- Persistent pessimism in the market

Wikiplast

Wikiplast