According to Wikiplast, recession still persists in both domestic and export markets and producers are not as motivated as before.

A major change cannot be expected while we are facing this situation. However, the inventories are extremely low and with a new wave of demand maybe we can hope for a phase shift in the market next week.

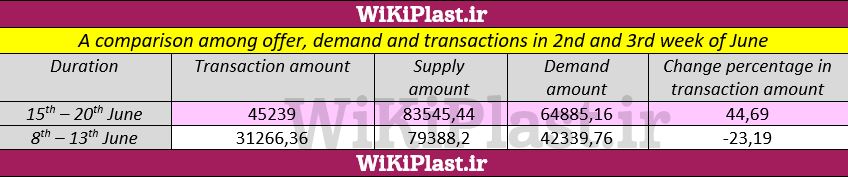

The amount of transactions is still lower than the average amount of last year, and this confirms the recession spotted in the official records

This week we had a slight improvement comparing to the heavy stagnation and customers’ reluctance which we had last week. However, no considerable growth is yet visible in the amount of transactions and Polymer stock market.

This is also the case for free market, which is experiencing a decline in the amount of transactions and total unwillingness for production in related industries.

The decreasing price trends of last week can be considered as a proof. The offer obviously exceeds the demand and this leads to a higher tendency to sell, in case the prices decrease even more.

The market, however, will focus on the basic fees in the following week and Dollar exchange rate will play an important role in this.

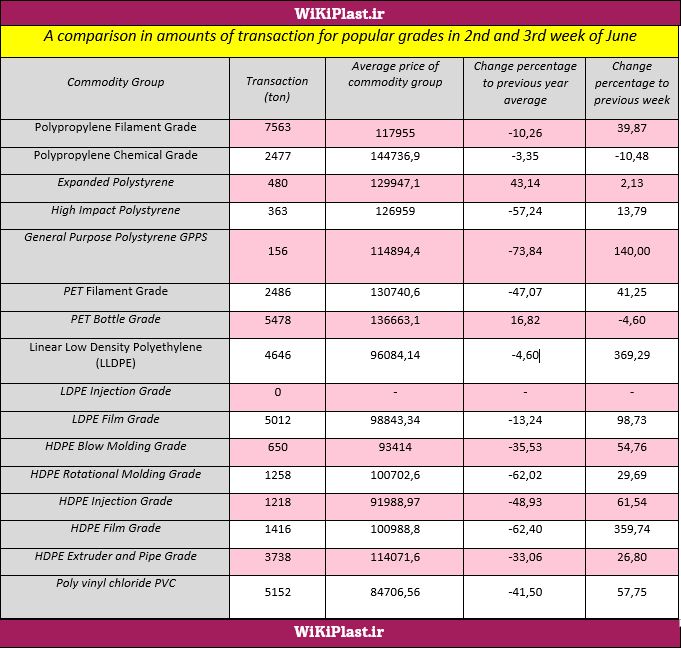

This week, some product groups experienced an increase in basic fees while some others experienced a decrease. Generally speaking, the market was not heavily impacted by the fluctuations in basic fees in stock market.

Meanwhile, thanks to the increase in demands and the amount of transactions, a slight competition among buyers could be observed. Especially for some attractive grades whose offer had declined on Monday.

This meant an increase in prices in stock market which did not practically affect the domestic market.

On the other hand, the previous fees have been calculated with Dollar exchange rate of less than 100000 IRR, while at the day of writing this report, the Dollar exchange rate has been more than 110000 IRR. This leads to an increase in exchange rate for basic fees during next week.

Although the global prices are decreasing in a slower manner than before, the diminishing trend is still visible among most grades.

There is a possibility for an increase in basic fees in stock market, but nothing is certain. We cannot be sure about the analysis and the actual prices could be surprising.

Such surprises have frequently happened in the past and the predictions are mere opinions, not facts.

During a total decrease in prices, we cannot expect a phase shift in the market, even if the basic fees experience an increasing trend. However, there is always a potential for a change in mechanisms.

The fact that the market has experienced a decrease in prices despite the growth in demands, demonstrates that the market is even weaker than it appears to be. Yet, an increasing trend in demand for any product group or any other change can impact the price of any grade.

Write your comment

Related contents

- Diminished offers and low trade rates

- Bare smell of a better market

- The exchange terror in polymer market

- A growth to just above the Harsh recession threshold

- The nightmare of an inflationary recession

- Is the market promising?

Wikiplast

Wikiplast