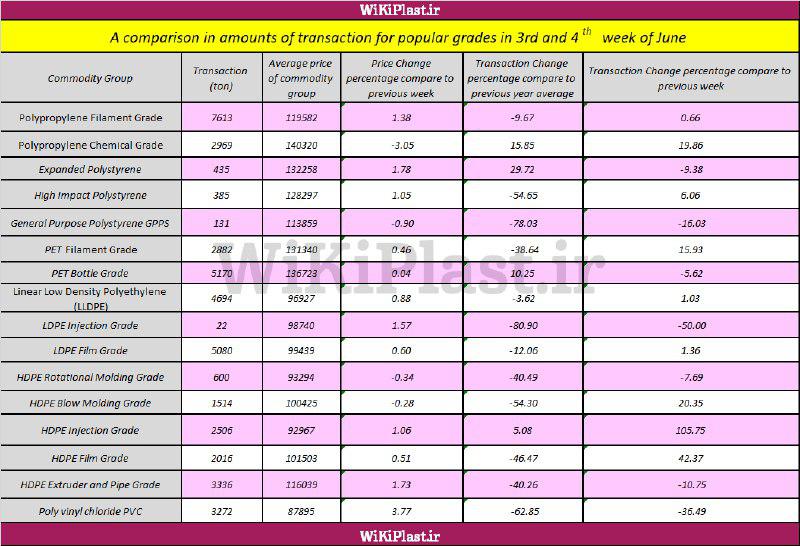

According to Wikiplast, the slight improvement in the amount of transactions in stock market is promising the possibility to end the current recession. Yet, the signs are not reliable enough. The increase in both demand and supply, along with the growth in the amount of transactions as well as some brief sparks of augmentation in prices can definitely be the result of some movement in the market. Absolute ending of the recession, however, might be false hope.

During last week, the increase in Dollar exchange rate and the general decrease in global prices caused some prices to fall and some others to grow.

The growth in the amount of transactions in the stock market resulted in more attraction and competition for buying and ended up in a final positive trend.

This state could go on for the next week and we may see a slight growth in prices.

Basic prices are also of undeniable technical and psychological value. Accordingly, no safe prediction can be made before the official announcement of these prices.

The recent fluctuations demonstrated that the market does not have the capacity of dramatic fluctuations. Observing a few positive sparks after some brief downfalls means that the market is keeping a fragile balance.

According to the trends of last week, both increase and decrease in prices could be anticipated for the following days. Generally speaking, the prices will most likely experience a steady state.

The total amount of transactions and the specific amount for some products are still lower than the same date last year. Therefore, we are definitely not past the recession.

The amount of exchanged polymers is less than 50 tons for the fourth consecutive week, which is an obvious sign of recession. However, a less severe version of the current situation was reported from mid October to early January.

During the past 2.5 months, the market experienced the semi-recession state which it is experiencing now. As a result, if the market is to stand on its own feet and start improving by its own internal elements, we shall have to wait a long time, especially if we take the external severities into account.

The increasing amount of transactions in the stock market, promising as it is, does not imply the termination of the recession. It cannot even be counted as a signal to support the market, due to other numerous limitations.

Due to the fact that Dollar exchange rate has fluctuated in different proportions in governmental and free market in Iran, along with the serious stagnation in demands, immediate improvement is improbable.

The slight increase in demand was partly because of some new restrictions. Some buyers decided to provide their needs in advance, in case some new restrictions are put into place.

If the amount of exchanged goods exceeds 50 tons in the next week, we can count that as a positive signal to get out of the current recession. There are certain manners of economical activity for recession periods which will be discussed later.

Write your comment

Related contents

- The exchange terror in polymer market

- A growth to just above the Harsh recession threshold

- The nightmare of an inflationary recession

- A Recession, Deeper Than Expected

Wikiplast

Wikiplast