A report on Petrochemical products market, 1st week of July 2019

The nightmare of an inflationary recession

According to Wikiplast, the market may still be stock in the difficult days, and the difficulties could even deepen when the prices start to rise with no supporting demand.

This inflationary recession would be a nightmare for the market. The fact that the prices are determined according to governmental exchange rate strengthens the probability of inflationary recession.If we observe no rise in the prices in the next week, the situation could be promising.

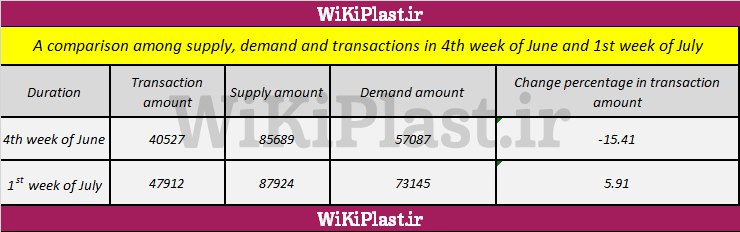

As mentioned in the last weekly report, the termination of the current recession was something we could only hope for. Not only the situation failed to meet our hopes, it even got more severe according to a 15.4% fall in amount of transactions as well as a 22% decrease in demand.

The statistics clearly illustrate a whole new level of weakness in the market. It might be possible to uncover the true reasons by probing into the situation more carefully.

No base prices were declared during last week and this could be one of the reasons why we experienced a downfall in the amount of transactions.

In the past, when base prices were declared every other week, we used to see that during the weeks in which no base price was declared, the amount of transaction experienced a usual decrease. That seems to be the case now as well.

However, the receding demands both in free market and export market could be stated as the main reason for the decline in the amount of transactions.

There are definitely other reasons too, such as absence of psychological momentums, stagnation of exchange rate, weak supporting industries, low amount of liquidity in domestic market and also the restrictions on the market.

In a situation that major dealers are already reluctant to buy, supervisory attempts such as shutting down some warehouses and adding bureaucratic procedures could only make thing worse.

The current circumstance will definitely affect the sales. It can even disrupt the normal flow of raw materials for good.

The current trend will result in receding amount of transactions. However, if the demands are not met, we may see an increasing momentum in the demands in the future.

Even a competitive atmosphere could be anticipated among buyers. Yet, now there is no evidence of such movements.There is a possibility that base prices increase in the following week.

The governmental exchange rate has increased by 2% while the decreasing trend in global prices has stopped as well.

This means the market is expected to experience an increasing momentum in the following week. Yet, this increasing trend would not be the result of an effective growth in the demands.

The situation is, therefore, more likely to become an inflationary recession, which is never good news for the market.Accordingly, if we observe a rising momentum in the prices next week, it will not necessarily be a positive change.

However, the declaration of prices, by itself, means a potential increase in the amount of transaction, but it cannot be counted as a sign to consider the recession terminated.

.jpg)

Write your comment

Related contents

- New hopes for further rise in demands

- Bare smell of a better market

- The exchange terror in polymer market

- A growth to just above the Harsh recession threshold

- Is the market promising?

- A Recession, Deeper Than Expected

Wikiplast

Wikiplast